[ad_1]

If there’s one factor that People can agree upon it’s that the divisions between us have solely grown deeper in the course of the previous 4 years and much more so in the course of the COVID-19 pandemic. I’ve written concerning the position of media, how synthetic intelligence feeds us what we’ve searched and spent probably the most display time on and the way that reinforces our biases. We’re certainly an algorithm-driven society.

Tatiana Bailey, director, College of Colorado at Colorado Springs Financial Discussion board

Many educators and economists have addressed the generational points of poverty and the way younger kids from deprived neighborhoods have the chances stacked towards them with much less per pupil funding and fewer house assist. COVID has put a painfully obvious highlight on these and different traits which have exacerbated lots of America’s worst structural issues. Like most individuals, I’ve nice anticipation and enthusiasm for the opposite aspect of this pandemic however my optimism is tempered, as a result of I do know these structural issues can be worse than they have been pre-COVID and won’t be going away when the pandemic is behind us.

As an economist, I plainly see that on the coronary heart of the issues is the marked revenue disparities that now outline our society. The bifurcated financial system largely explains why we now have the best murder price within the developed world and excessive crime charges on the whole. It explains why our instructional outcomes are subpar and deteriorating. It explains why our nation is more and more and angrily divided politically. It explains why opioid and different drug use is prolific among the many primarily unskilled/low expert swaths of our nation.

It’s merely not sustainable to have the extremes we do by way of revenue and wealth. But to some, making this assertion elicits a “socialist” labeling when satirically, capitalism is constructed upon the premise of alternative and incentives. It’s an announcement of indisputable fact that thriving economies and secure societies shouldn’t have equal revenue, however a variety of revenue that permits the decrease revenue quartiles to have primary wants met whereas having true alternative for social mobility. When backside earners work and pay taxes, can afford to be lively customers and don’t pull from social help, capitalism, and society as an entire, perform higher.

However this isn’t the place we’re. The highest 1% of U.S. earners account for 21% of the nation’s complete annual revenue whereas the bottom incomes 25% account for under 3.7% of complete U.S. annual, revenue in keeping with IRS 2017 revenue knowledge. The highest 1% of households had a mean annual revenue of $2 million whereas common revenue for the bottom 20% was $21,300, in keeping with 2017 Congressional Funds Workplace (CBO) knowledge. For those who do the mathematics, the common revenue of the highest 1% of households is 94 occasions that of the underside 20%.

As a result of higher-income households make extra and since they pay a better tax price, in addition they pay proportionately extra in revenue taxes. IRS knowledge reveals that the highest 50% paid 97% of complete revenue taxes whereas they earned 89% of complete U.S. revenue in 2017. In addition to revenue taxes, nonetheless, working taxpayers who earn wages additionally pay different taxes comparable to federal payroll taxes for Social Safety and Medicare, whereas nearly all people pay state and native taxes. Keep in mind that “revenue” contains wages and salaries, curiosity, dividends, pensions, rental and revenue from different sources.

I’ll pause right here and state that it is very important take a look at the info from different angles. For instance, I do know that averages are skewed by outliers comparable to the highest .01% of households that had a mean revenue of $48.5 million in 2017. It was additionally each fascinating and extremely time-consuming to unpeel all of the layers of inventive knowledge manipulation within the many (left and right-leaning) biased sources I encountered. For these causes, I additionally determined to take a look at two different monetary metrics sticking firmly to authorities sources with clear methodologies.

Earned wages are one other means to take a look at monetary standing and this data is made accessible by means of Social Safety Administration knowledge. “Wages and ideas” don’t embody different monetary assets comparable to dividends as does the “revenue” metric above. This wage knowledge was accessible for 2019 and it exhibits that the highest 1% (2.7 million of the 170 million employees) earned 16.2% of all wages whereas the underside 25% (44 million employees) earned 3.1% of complete wages. The underside 50% (86 million employees) earned 15.1% of complete wages. And the chasm has grown wider through the years. From 1979 to 2017, actual wages for the highest 1% elevated 157% whereas the wages for the underside 90% grew 22%. A better share of “revenue” will accrue to the highest percentiles than would be the case for “wage earners” as a result of greater revenue people are likely to get hold of extra of their monetary positive aspects from investments and actually, don’t at all times work for wages.

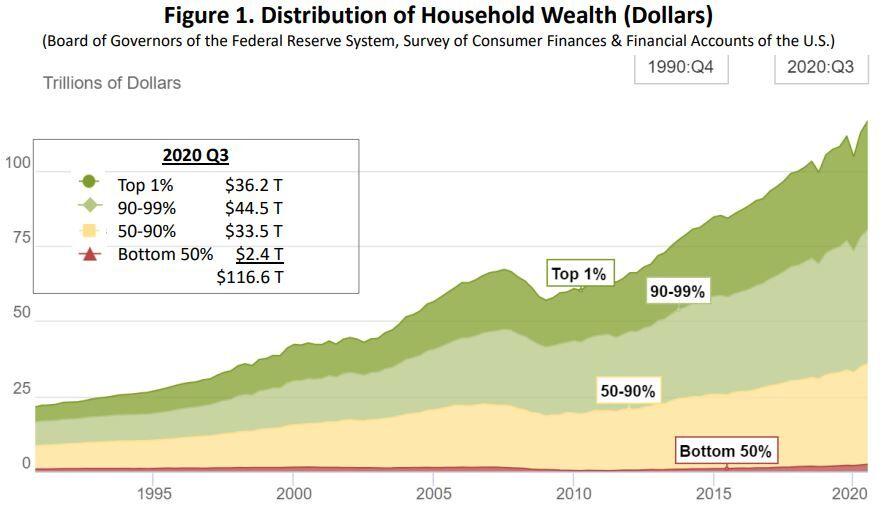

One other essential metric to take a look at is wealth or web value. This knowledge is accessible from the Board of Governors of the Federal Reserve System. This metric incorporates belongings comparable to cash in financial institution accounts, automobiles, and houses minus the money owed owed. A family with greater earnings and/or revenue sometimes accrues extra belongings and is extra capable of repay money owed. The inverse of that can also be true with decrease earners. Particularly throughout downturns, wealth may be an essential buffer because the lack of a job or different revenue supply may be offset with drawing down financial savings, and leveraging and even the promoting of belongings (e.g. promoting shares or downsizing a house).

The Fed tracks this knowledge on a quarterly foundation and 2020 Q3 knowledge exhibits that the highest 1% had 31.0% of the full wealth ($36.2 trillion), these within the 90-99% had 38.2% of complete wealth ($44.5 trillion), these within the 50-90% had 28.7% of complete wealth ($33.5 trillion) and the underside 50% had 2% of complete wealth ($2.4 trillion) in the US (Figures 1 and a pair of).

The dearth of wealth for the underside 50% can be one of many defining points of this recession and can end in a vastly uneven restoration. The underside 50% signify many of the laid off employees and their lack of wealth implies that they don’t have the belongings to assist cushion wages misplaced and funds missed. Moreover, their credit score could also be broken throughout this year-long disaster, which can hamper their skill to construct belongings, like a house, sooner or later.

These revenue/wage/wealth discrepancies are a lot of the rationale the Federal Reserve has been so vocal concerning the want for fiscal stimulus to the households and small companies that want it probably the most. The “backside 90%” are the vital mass of what makes up American society.

Turning again to incentives, let’s now take a more in-depth take a look at the poorest contingent who’re at or under the federal poverty stage (FPL). The FPL for a person, which is the edge for receiving Medicaid and different federal help, is at present $12,760 and $26,200 for a household of 4. If somebody works full time on the $7.25 minimal wage, they make $15,080 a 12 months, however usually these jobs don’t provide well being advantages, whereas being beneath the FPL creates entry to well being advantages.

It’s not shocking that many individuals who shouldn’t have entry to greater training and better incomes potential select to not work given this tradeoff between full-time, low-pay work and receiving social help. Likewise, it’s not shocking that many females select to not work due to the excessive value of kid care. Larger training can also be more and more out of attain with even middle-income households discovering it troublesome to afford greater training for his or her kids. Many faculty levels don’t at all times guarantee a dwelling wage anymore, so extra people are questioning the return on funding of upper training, particularly with excessive scholar debt load. The motivation construction simply isn’t so clear anymore.

But, the outrageous expenditures on packages like Medicaid make for large headlines and many skepticism. However wouldn’t it’s cheaper to deal with the basis causes of poverty and make systemic investments in eradicating poverty than it might be to pay all these switch funds to poorer households? Over time, we’d even scale back the proportion of people who find themselves financially struggling within the U.S. and decrease total prices in the long term. However now we’re in a state of affairs the place 160,000 companies have shuttered in the US and 35% of adults will not be present on lease or mortgage the place eviction or foreclosures within the subsequent two months is probably going. 13 p.c of U.S. households haven’t had sufficient to eat within the final seven days (Census Pulse Survey). As an American, I ponder how we acquired right here.

However perhaps we may use this disaster and the necessity for fiscal stimulus to do a New Deal 2.0. Initiatives like infrastructure spending put individuals to work, however how a couple of nationwide coaching marketing campaign? This can be a long-term stimulant to the financial system that yields financial profit lengthy after a recession or despair as a result of individuals maintain onto what they’ve discovered. The highest job openings within the U.S. are chronically open (nurses, many well being care tech positions, laptop directors, truck drivers, and so on.).

We’ve got an acute expertise hole within the U.S. as know-how has quickly modified and the requisite expertise have concurrently modified. You need individuals to work? Train them the abilities they should work. It additionally helps companies who chronically state they’ll’t discover employees with the abilities they want. Use federal funds to pay for the coaching of prepared contributors. Will probably be cheaper than chronically paying unemployment insurance coverage, paying for Medicaid and meals stamps, and excessive incarceration charges.

Ladies have left the workforce in droves throughout this pandemic and if we would like them to return, how about subsidizing high quality little one care, early training and higher instructor pay? These packages basically pay for themselves within the medium and future as a result of employees feed again into the system by paying taxes.

Such initiatives are politically impartial as a result of nobody argues with placing individuals to work. And whereas we’re at it, audit the highest job openings in the US and work with Okay-12 and better training to coach our youth for the roles of right this moment. All of this may even improve our international competitiveness.

I believe it’s totally American to consider and work in the direction of serving to different People no matter anybody’s political affiliation. I believe it’s totally American to appreciate how nice we’re, however how onerous we should collectively work to keep up or regain our greatness.

For example, consultants mentioned a pandemic was coming (and nobody believed them). Local weather consultants are saying we’re reaching the purpose of no return by way of irreversible and extremely costly catastrophic impacts from carbon emissions. I do know public well being and economics, however not the science of local weather. However I belief good People and world residents who’re local weather consultants. Environmental challenges are fairly probably the following pandemic. I believe it’s totally American to innovate so why not be a world chief in large funding in inexperienced applied sciences? Even when local weather change is a hoax, it’s a good way to create jobs (and hold our Colorado skies blue).

These are investments in long-term sustainable financial progress which might be additionally investments in People. If we elevate up everybody, we’re really one nation beneath God, indivisible as any sturdy nation have to be.

[ad_2]

Source link