[ad_1]

The ESG Insider publication compiles information and insights on environmental, social and governance developments driving change in enterprise and funding selections. Subscribe to our ESG Insider newsletter, and hearken to the ESG Insider podcast on SoundCloud, Spotify and Apple Podcasts.

It is our closing ESG Insider publication of 2020, a yr that introduced large change within the sustainability world. Amid the pandemic, corporations and traders more and more emphasised social points comparable to employee security. The demise of George Floyd within the U.S. introduced heightened focus to racism and systemic inequality. And whereas local weather points might have been briefly sidelined by COVID-19, they remained in sharp focus for traders, regulators and firms worldwide.

Here is how Carlo Funk, State Road World Advisors’ EMEA Head of ESG Funding Technique, put it in a latest interview with ESG Insider: “This horrible yr in relation to the pandemic and COVID really led to a better prioritization of ESG integration normally, a better prioritization of social points particularly, however didn’t result in a de-prioritization of local weather by any means however has really pushed climate-related issues increased up on the ESG agenda.”

You may hear extra from Funk and plenty of different large ESG names in our subsequent episode of the “ESG Insider” podcast, the place we’ll sort out themes to observe within the yr forward.

Comfortable New 12 months, and we’ll see you in 2021.

Chart of the Week

Prime Tales

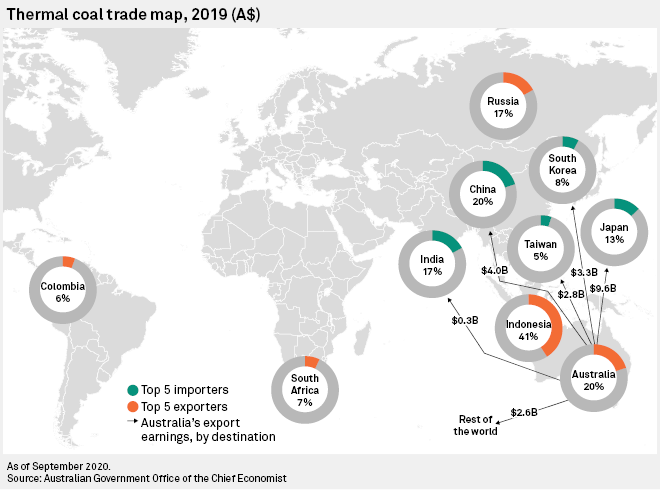

Australia’s thermal coal financing choices scaling down, however hope alive in Asia

As Australia’s key thermal coal prospects undertake carbon neutrality targets, new undertaking financing could also be threatened because the Large 4 banks on this planet’s second-largest thermal coal exporter proceed to distance themselves from the more and more contentious commodity. Our Chart of the Week, above, exhibits the highest importers and exporters of thermal coal.

‘No person willingly pays themselves much less’: Exec pay reform might be uphill battle

The financial disaster introduced on by the COVID-19 pandemic has exacerbated the disparity between U.S. shale executives’ compensation and shareholders’ long-term pursuits, based on a non-public fairness agency with a historical past of shareholder activism.

Europe’s utilities see heavy churn as a dozen CEOs depart in lower than 2 years

The previous few years introduced a wave of management modifications at European energy and fuel corporations because the business shifted away from fossil fuels and embraced renewable vitality. In 2020, 12 of 25 of the biggest private and non-private vitality utilities have switched leaders or introduced that their CEOs will depart earlier than the tip of 2021.

Environmental

MEA banking tales to observe in 2021: Inexperienced financing, Lebanon, Kenya

How ‘the Tesla’ of fund managers is shaking up the renewables business

Bipartisan US Home invoice would set nationwide clear electrical energy normal

Social

Social bond market, therapeutic COVID-19 divisions, set to proceed rising

Annual US coal fatalities poised to hit document low as business declines

Rio Tinto appointment of Stausholm as CEO receives blended critiques

Governance

Activist investor group recordsdata local weather decision at 3 European oil majors

Challenges forward for Talen Power because it retires coal

Credit score Financial institution of Moscow raises ESG-linked $20M mortgage from LBBW

ESG Indices

Upcoming Occasions

Emerging Markets: A New Generation of ESG Leadership

SRI Convention & Neighborhood

Jan. 12, 2021

On-line

MSCI 2021 ESG Trends to Watch

MSCI

Jan. 14, 2021

On-line

21Testing the application of the EU Taxonomy to core banking products: High level recommendations

European Banking Federation and UNEP FI

Jan. 26-27, 2021

On-line

GreenBiz

GreenBiz

Feb. Sept. 11, 2021

On-line

ESG Summit 2021

Pension Bridge

Feb. 23-Feb. 25, 2021

On-line

Sustainability Week

The Economist

March 22-March 25, 2021

On-line

Questions or ideas? Contact S&P World Market Intelligence’s ESG Information group at ESGNews@spglobal.com

[ad_2]

Source link