Notice: Undefined offset: 1 in /home/digit572/adidasblog.com/wp-content/themes/jnews/class/ContentTag.php on line 86

[ad_1]

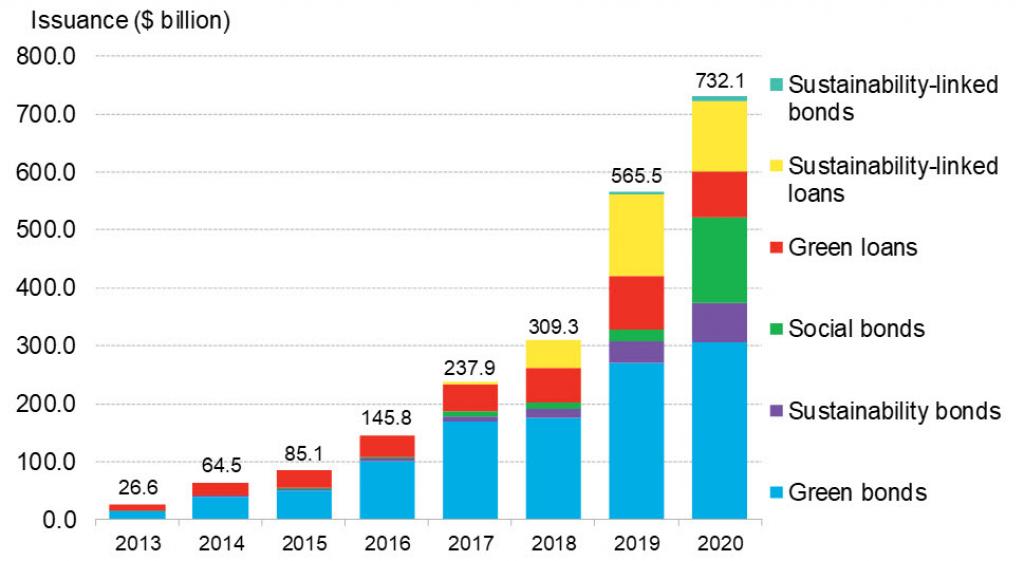

Sustainable debt value $732 billion issued globally; $305 billion of that in inexperienced bonds

The novel coronavirus illness (COVID-19) pandemic might have affected a number of efforts to fight local weather change in 2020, however it didn’t decelerate the nascent sustainable debt sector. A report $732.1 billion (Rs 53.6 lakh crore) value sustainable bonds and loans had been issued final yr, 29 per cent greater than in 2019, in response to a current report.

Inexperienced bonds, the oldest of the sustainable debt devices, rose 13 per cent to set an issuance report of $305.3 billion.

Social and sustainability bonds grew persistently whereas inexperienced bonds surged later within the yr, in response to the report launched January 11, 2020 by power analysis organisation BloombergNEF.

Issuance of social bonds, which increase cash for social aims corresponding to employment, public well being and schooling, jumped seven folds to $147.7 billion. Sustainability bonds grew 81 per cent to $68.7 billion.

Alternatively, issuance of each sustainability-linked loans and inexperienced loans decreased 15 per cent to $119.5 billion and $80.3 billion respectively.

World sustainable debt annual issuance, 2013-2020

Supply: BloombergNEF, Bloomberg L.P.

Mallory Rutigliano, a sustainable finance analyst at BloombergNEF, mentioned:

“Covid-19-related disruption affected issuance of some sustainable debt devices in 2020, however spurred others. General development of virtually 30% available in the market confirmed that sustainability continues to stand up on the agenda for buyers, companies and governments. This comparatively new market is now being seen as a device world economies can use to construct again greener and socially fairer.”

The swell in social bond issuance was pushed by merchandise addressing the coronavirus pandemic and the recession. The overwhelming majority of issuance of those bonds got here from authorities companies and supranational our bodies that borrowed cash for healthcare and aid aims.

The yr 2020 noticed the biggest single social bonds issued ever, from entities such because the European Union, Unedic, and African Growth Financial institution.

Choices by means of inexperienced bonds, raised to assist environmental actions, surged in September with a whopping $62 billion. The expansion continued within the fourth quarter and took the overall issuance since 2007 to greater than $1 trillion.

We’re a voice to you; you’ve got been a assist to us. Collectively we construct journalism that’s unbiased, credible and fearless. You may additional assist us by making a donation. This may imply rather a lot for our capability to convey you information, views and evaluation from the bottom in order that we are able to make change collectively.

[ad_2]

Source link