[ad_1]

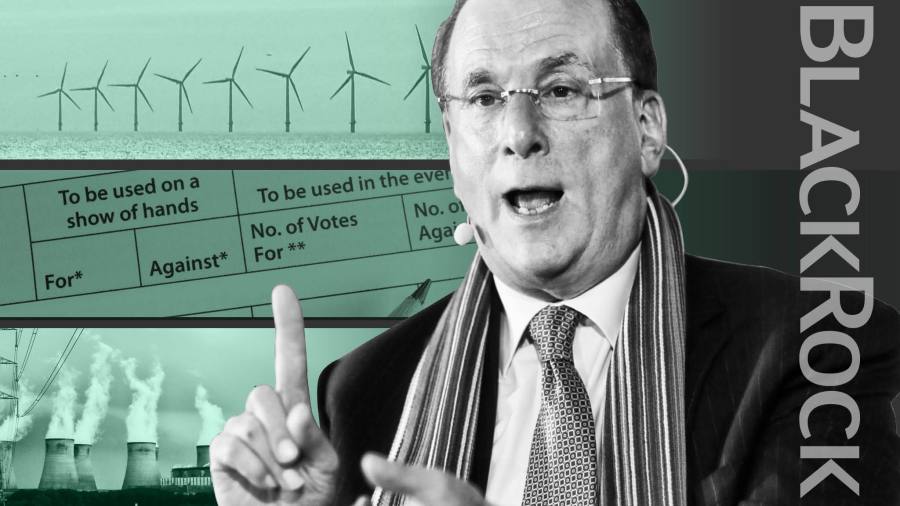

When BlackRock chief Larry Fink issued his annual company missive to chief executives final January, he promised an enormous shake-up on the world’s largest asset supervisor.

With world warming driving a “basic reshaping of finance”, Mr Fink stated it was time for BlackRock to place sustainability on the coronary heart of how the $8.7tn fund home invests.

BlackRock would launch new merchandise, take into account environmental, social and governance points in funding selections, promote some coal holdings and overhaul the way it offers with corporations.

His pronouncement got here after years of criticism that BlackRock had been too sluggish to behave on ESG points, significantly local weather change.

The concentrate on sustainability was extensively welcomed, but in addition met with scepticism. “You will need to acknowledge that BlackRock saying that local weather change is a giant funding danger is a constructive signal,” says Diana Better of the BlackRock’s Massive Drawback marketing campaign, a community of local weather activist teams. “There have been nice elements of Larry’s letter, however we nonetheless had questions.”

With Mr Fink’s 2021 letter due this month, we glance again at BlackRock’s progress thus far.

Stewardship

What BlackRock stated it might do: Evaluation its voting insurance policies, enhance transparency round its stewardship actions, and begin to vote in opposition to board administrators if corporations weren’t making adequate progress on sustainability points.

What it has carried out: There was a giant shake-up in BlackRock’s stewardship actions, which incorporates discussions with corporations internationally and its voting at annual conferences. Sandy Boss was employed to guide the division final yr.

The group has targeted on growing transparency round its voting and stewardship actions, together with publishing extra so-called voting bulletins on controversial votes. It additionally reviewed its stewardship insurance policies and in December dedicated to backing extra shareholder resolutions on climate change, after criticism prior to now it had didn’t assist such proposals.

BlackRock has already began to vote in opposition to boards at annual conferences, punishing 62 administrators final yr on account of climate-related points. It has ramped up its engagement with 440 carbon-intensive corporations.

Catherine Howarth, chief govt at ShareAction, a accountable funding charity, says the choice to vote in opposition to administrators might have a big effect by forcing boards to extra carefully handle investor issues.

The stewardship enhancements meant that BlackRock acquired a B grade for engagement, up from C+ a yr in the past, in an annual rating of huge asset managers from InfluenceMap, a London-based think-tank. However it nonetheless lags behind a lot of its European friends.

“Our view is that they have gone from being fairly a good distance behind the curve to simply behind the curve. They’ve loads to do to meet up with . . . a few of their European rivals,” says Dylan Tanner, govt director at InfluenceMap.

Placing ESG on the coronary heart of the funding course of

What BlackRock stated it might do: Combine ESG in funding portfolios, launch new trade traded funds and different merchandise targeted on ESG, and publish the sustainability of every fund, together with carbon footprint and controversial holdings.

What it has carried out: BlackRock says ESG has been built-in into all of its energetic and advisory methods, overlaying about $2.7tn of its property beneath administration. It has doubled the variety of ESG index choices, in addition to actively managed sustainable merchandise.

Local weather Capital

The place local weather change meets enterprise, markets and politics. Explore the FT’s coverage here

Additionally it is now attainable for traders to verify how sustainable BlackRock’s retail funds are throughout varied metrics, together with carbon depth, and to verify for publicity to controversial holdings, equivalent to corporations behind civilian firearms.

Ms Greatest, nonetheless, says that even with these actions, BlackRock has a “passive drawback” — with billions of {dollars} of property not topic to the identical sustainability necessities as their energetic methods.

“With out tackling the passive drawback, BlackRock will stay closely uncovered and the most important investor in coal, oil and fuel,” she says.

“They’re an absolute behemoth of an organization,” says Ms Greatest. “They completely have to get this proper as a result of they’re a make or break for our local weather.”

Coal restrictions

What BlackRock stated it might do: Divest from fossil gas corporations that generate greater than 25 per cent of their revenues from thermal coal by the center of 2020 in its discretionary energetic funding portfolios.

What it has carried out: BlackRock says it has ditched coal as pledged. However campaigners say the asset supervisor has not gone far sufficient, arguing its exclusion coverage applies to solely a small part of the coal trade and its property beneath administration.

“With the intention to successfully exclude the coal trade, BlackRock ought to drop all corporations which can be planning to increase current or construct new coal infrastructure,” says Katrin Ganswindt, finance campaigner at Urgewald, a non-profit. “On the very least, corporations with a coal share of income of 20 per cent and a coal share of energy manufacturing of 20 per cent must be excluded from BlackRock’s portfolios.”

A report this month by Reclaim Finance, a non-profit, and Urgewald stated BlackRock remained extremely uncovered to the coal sector, with holdings totalling $85bn.

BlackRock, nonetheless, has used its vote at annual conferences to punish corporations over coal, voting in opposition to administrators at teams equivalent to Fortum, and supporting a shareholder proposal at AGL Energy.

Nonetheless, a lot of their most vocal critics have been constructive about BlackRock’s progress over the yr, even when they consider there may be nonetheless work to be carried out. As Ms Howarth says: “BlackRock is able to a lot affect and influence. It’s our job to maintain difficult and hold the warmth on them.”

What BlackRock pledged in 2020

-

Combine environmental, social and governance issues into all energetic administration selections in 2020

-

Divest from fossil gas corporations that generate greater than 25 per cent of their revenues from thermal coal in its discretionary energetic funding portfolios

-

Alternate options enterprise will abandon any new direct funding in corporations that generate greater than 25 per cent of revenues from thermal coal

-

Publish particulars on the sustainability profile of each mutual fund, overlaying areas equivalent to their carbon footprint or information on controversial holdings

-

Start providing sustainable variations of its mannequin portfolios

-

Double its variety of ESG trade traded funds to 150 by finish of 2021

-

Develop the variety of low-carbon methods — no timeframe

-

Disclose voting data quarterly moderately than yearly

-

Disclose what matters it discusses with corporations throughout conferences

-

Require corporations to reveal in keeping with the Process Power on Local weather-Associated Monetary Disclosures and the Sustainability Accounting Requirements Board

-

Set a purpose of accelerating sustainable property beneath administration by greater than tenfold this decade — from $90bn in January 2020 to greater than $1tn

[ad_2]

Source link